The State of the Tech Market in 2023 - The Pragmatic Engineer Guest Post

A Guest Post on the State of the Tech Market in 2023 by Gergely Orosz, author of The Pragmatic Engineer.

Every week, I send an article to my paid newsletter subscribers (with a preview sent to my free mailing list). I'm enjoying the experience of learning to write consistently, identifying what you (the customer) are interested in hearing more about, and in general, sharing things I've learned over the years.

Another thing I've enjoyed is that I get to meet all sorts of interesting people in the industry. I recently caught up with Gergely Orosz, the author of The Pragmatic Engineer newsletter. He and I had a chat about our career trajectories, what drives us to write, and what we've learned along the way.

Considering I was a subscriber to his newsletter, and he was a subscriber to my newsletter, we recognized that our customers would likely have an interest in each other's publications. We decided it would be fun to trade newsletters for a day. Today, I'm going to send out one of his newsletters, and he'll be sending out one of my newsletters.

I've never done this before. I've written one article per week since the newsletter was founded. But I love trying new things.

I hope you appreciate the variation, and can learn something from his newsletter. I highly recommend his newsletter to anyone in our industry.

The State of the Tech Market in 2023

As seen in The Pragmatic Engineer's newsletter. Reflecting on the tech market from compensation, VC funding and RTO dimensions. What are the fundamental shifts happening that we’ve not seen in more than a decade?

It’s been more than 18 months since we covered the “perfect storm” which fuelled a super hot hiring market in 2021. Since then, things have changed – a lot. In this issue, we take a look at the forces moving the jobs market today — similarly to how we did in late 2021.

Also, I’m collecting a variety of observations from various data sources for a follow-up issue, which will cover what hiring managers are seeing, and provide a summary of trends. If you are a hiring manager, you can share your input here. Thanks a lot in advance!

Today, we cover:

VC funding lagging behind

Downward pressure on tech compensation

Nosedive and recovery for new grads’ salaries in the US?

Stagnation across the rest of the market

The impact of Big Tech layoffs

Return to office (RTO) policies in full force

Fundamental change in the tech market

Here’s a brief overview of how I see the market, today:

1. VC funding lagging behind

High-growth tech companies and venture funding have always gone hand-in-hand. With venture funding in place, tech companies can race ahead by hiring quickly and building products in the hope customer demand will follow. If it does, companies can then raise more money, grow faster, and not worry for years about turning a profit. Basically, VC funding enables a focus on growth first, and profits second.

Without VC funding, tech companies grow much more slowly; they validate ideas at a smaller scale, find customers, sell to them, turn a modest profit, and then reinvest profits in more hires. This approach is called “bootstrapping,” which forces companies to focus on profit first, and growth second.

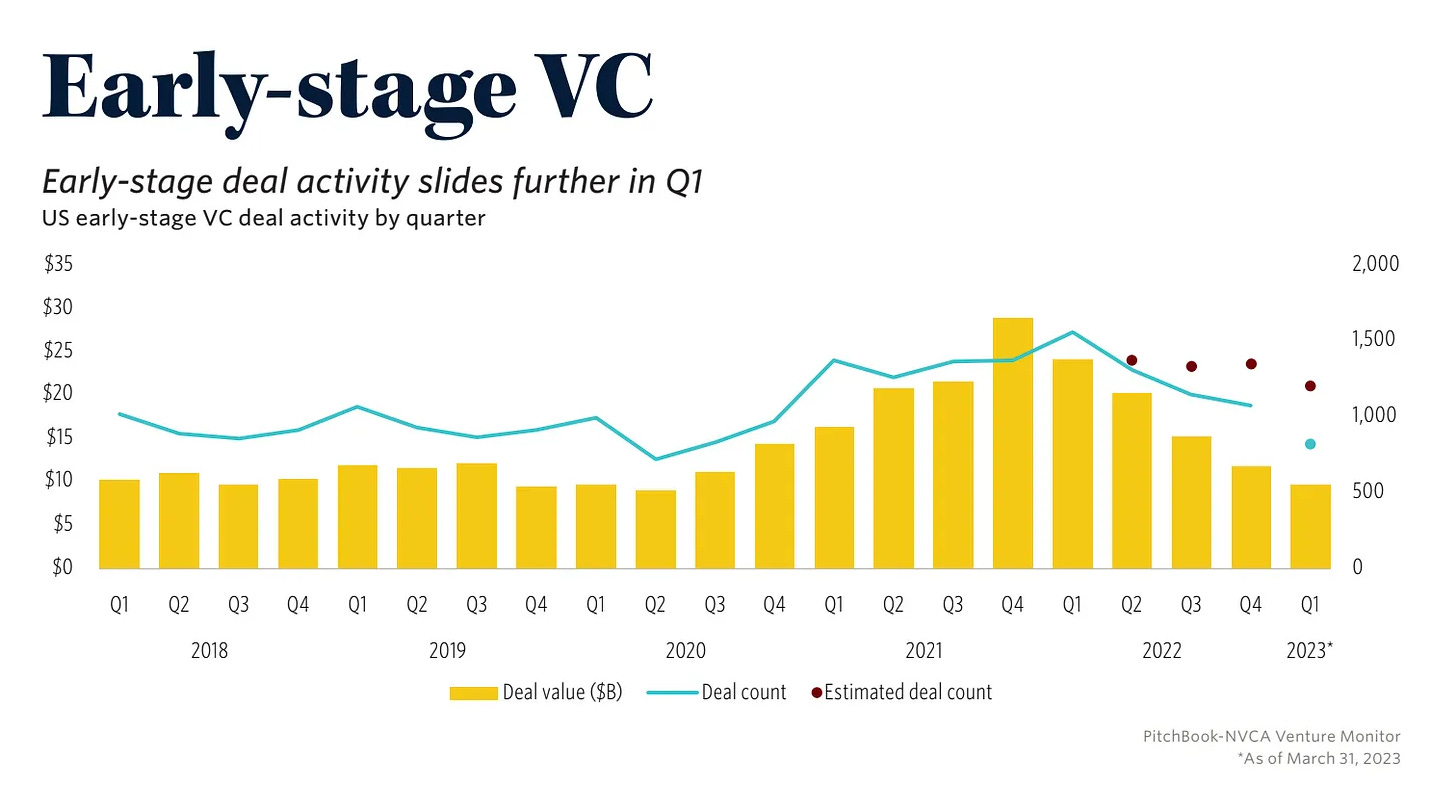

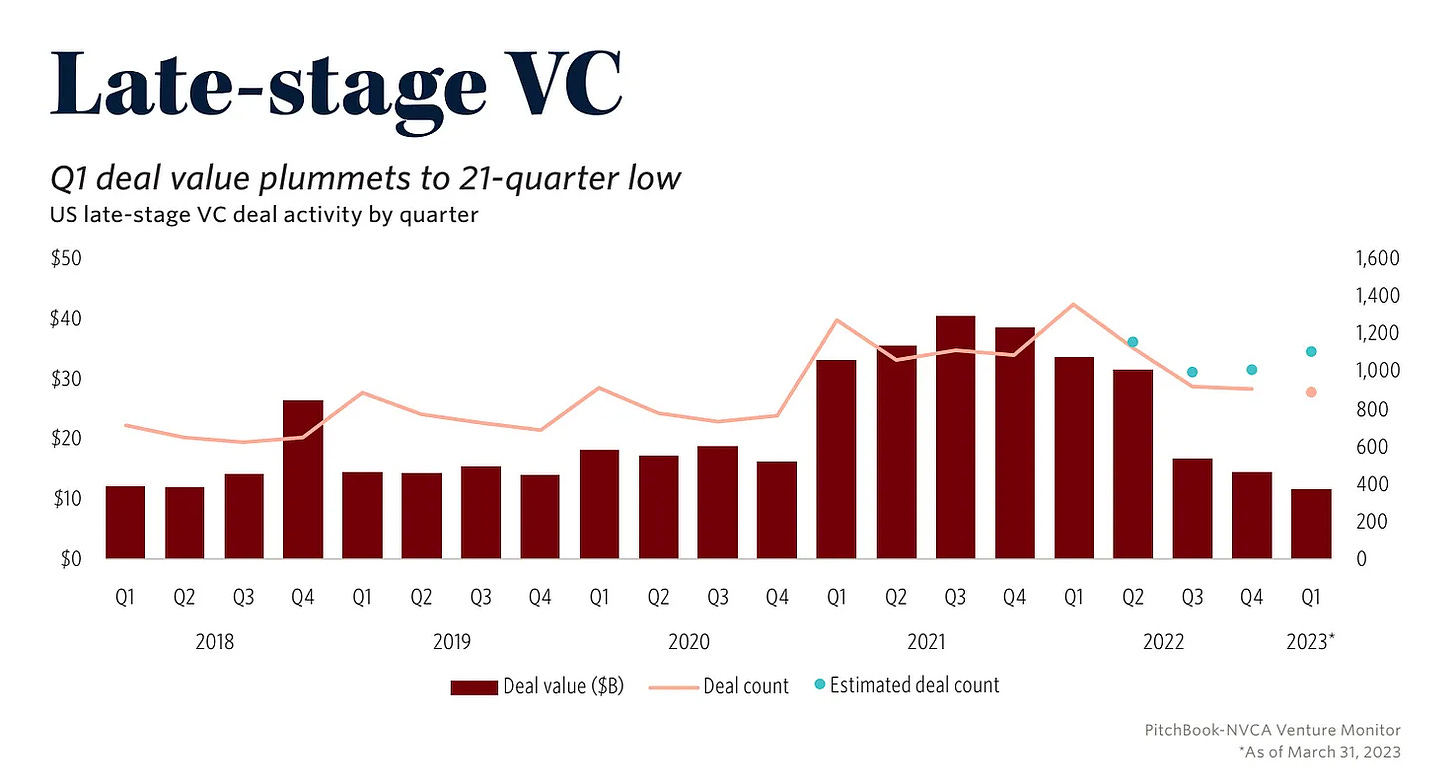

Today, startup funding is trending down, as we covered in April in The state of startup funding in Q1 2023:

The outlook for VC funding appears gloomy. The way venture capital works is like this:

1. Venture firms raise a new fund for investing in tech businesses. These funds are gathered via commitments from Limited Partners (LP,) which may be pension funds, high net worth individuals, governments, or organizations with capital to invest which are okay with “locking up” their money for around 10 years in the expectation of a handsome return in future.

2. Once a fund is raised, the VC invests it in startups of various risk profiles.

3. VCs make money two ways:

Management fee: charging an annual management fee based on the amount invested, usually between 1%–2.5%; meaning a $100M investment yields a $1M–2.5M fee per year. Management fees tend to decrease once the fund is no longer investing: so it’s not uncommon to have ~2% for the first 3-5 years of the fund, and below 1% in following years. Note, this structure tends to incentivizes VCs to invest money fast — and then raise a new fund, when they invested the funds —, otherwise they don’t get a cut of the management fee.

“Carry.” This is a percentage of the fund’s profits paid to the VC, after the fund has returned a multiple of the principal balance. Carry tends to vary between 15–30%. So, if a $100M fund grows to $500M in value at maturity, that’s $400M of profit with the “carry hurdle rate” passed. The VC would make $60-120M as a result, from this profit. However, say that the fund “only” grows to $150M and doesn’t pass the hurdle: then the VC would not get any carry, and only have the management fee. (Thank you to reader Will for the correction!)

Raising funds from LPs is necessarily the first step in the venture funding process. Without funds, there will be no investment. Today, there are several signals that the largest venture funds are struggling to raise their next funds, which suggests a lack of interest or confidence in tech among investors. This will impact the volume of VC funding over the next several years. Indeed it’s already doing so:

Tiger Global is one of the largest venture investors in tech, having invested early in Coinbase, Databricks, Facebook, LinkedIn, Nubank, Quora, Spotify, Stripe and Waymo. The company has raised a new $2.7B fund, which is good news. The bad news? The target for this fund was $12B just 18 months ago, and $6B 9 months ago, as reported by The Information.

Just as worrying is that Tiger Global’s $12.7B venture which was raised in 2021, is at a 20% loss already, also reported by The Information.

It’s pretty clear Tiger Global is having trouble convincing LPs to invest. And to be fair, LPs have reasons to be reluctant: with the FED interest rate at 5%, they can get a very decent return by keeping their money in the federal reserve – especially now that 2021’s investments are already in the red.

Pitchbook reports Tiger Global took the unusual step of offering to sell its stake in existing investments, and then use the proceeds for its new funds. Again, this shows Tiger Global doesn’t have much confidence in those 2021 investments, and would rather put the money in new startups – if only it had the funds!

Insight Partners is a New York-based VC firm which previously invested in the likes of Calm, Checkout.com, Pluralsight, Qualtrics and Udemy. The company is one of the largest growth-stage investors, with $90B worth of assets in the US alone.

The company aimed to raise $20B for its next fund, and started marketing this fund on 1 June. While it raised $2B in less than a month, according to The Financial Times, the pace of fundraising is slower than expected, and Insight Partners has reduced the target size to $15B. It’s also slowing down deployment of funds, too, reports The Financial Times:

“Venture capital fundraising soared to record levels during the pandemic, with firms raising a total of $159B in 2021 and $171B in 2022, according to PitchBook. But that has collapsed in the last six months, and US venture funds raised just $12B in the first quarter of this year.”

We are likely seeing a “great VC reset” across tech. Venture funding is not vanishing altogether, but it sure is getting smaller. And looking ahead to the next few years – based on funds being raised now – the volume of capital which VC allocates to tech looks like it will be much smaller than in the period 2020-22. The question is, will it be lower than in 2019 and earlier?

In contrast, one area seeing lots of investment is everything Artificial Intelligence (AI)-related, and generative AI-related. Replit raised $100M to grow its AI-powered development platform in April, while a vehicle inspections company, UVeye raised $100M in May. And most eye-catching of all, a 4-week-old startup in Paris raised €105M ($115M) in seed funding in exchange for giving up 43% ownership of the company.

2. Downward pressure on compensation at the top of the market

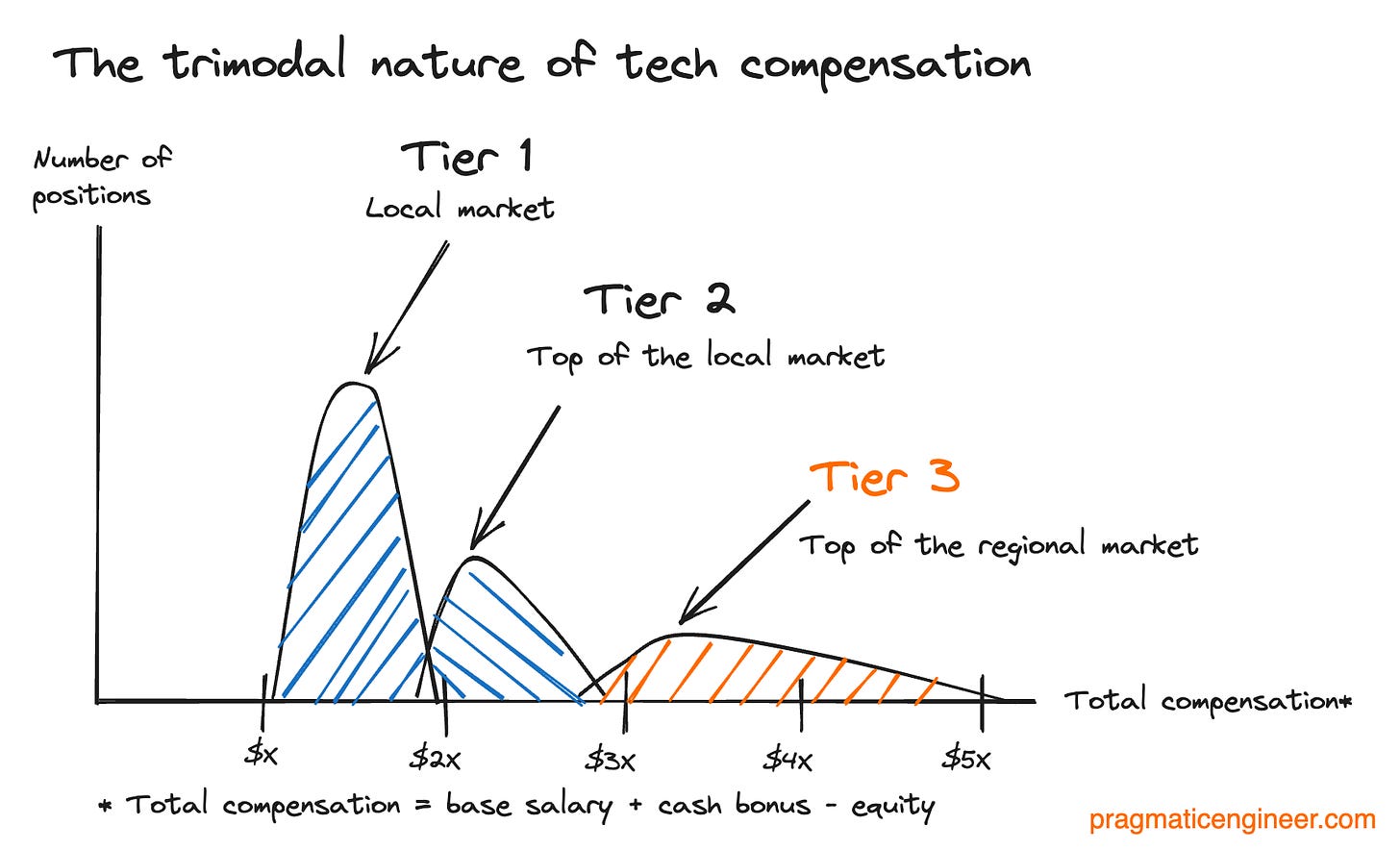

What happens at the top of the market tends to impact the rest of it, compensation-wise. Let’s talk about the top tier, which I refer to as “Tier 3” in this trimodal model:

Netflix: no raises in 2022. As covered back in October 2022, the streaming giant made clear most staff would not get raises last year. And in all fairness, this decision was not that unexpected, as I wrote at the time:

“Netflix’s assessment is correct, in my view. Though software engineers were disappointed to read the message telling them to not expect raises, I do think Netflix is right to say most staff are paid above the market, based on the tech market today. (...)

The total compensation of most people working in Big Tech has declined. The only people not making less money than in March 2021 – assuming they have not changed jobs – are those who work at Apple, Tesla or Microsoft, who are making roughly the same. The other group is those who got promoted, received a larger-than-usual retention bonus, or changed jobs.

Most people working at Netflix rocketed to the top of the market by not being exposed to stock volatility.”

Microsoft: no raises in 2023. Last month, Microsoft told staff not to expect pay increases for full-time salaried employees this year, which are communicated in August. Software engineers I talked to at the company were understandably upset, especially with inflation at nearly 5%.

Pinterest: target compensation reduced by ~30% from 2020-21 levels. Pinterest was paying top of the market compensation, despite being one of the increasingly few companies to support full-remote work. We cover this in The Scoop #51.

However, some Tier 2 and Tier 3 companies have increased compensation. Shopify recently surprised most employees with 3-6% raises, while HubSpot handed out even larger raises of between 15-25% in April.

But there’s a comparison to make: Pinterest and Netflix used to pay more than Shopify and HubSpot in the US and the United Kingdom (UK.) But with compensation targets reduced at Pinterest, this may no longer be so. For example, after Pinterest’s compensation targets, here’s what the UK numbers look like:

Senior engineer (L15): £153K total compensation target ($195K / €179K.) This is as £81K base salary midpoint, £73K/year equity midpoint.

Staff engineer (L16): £197K target ($252K / €230K) as £101K base, £96K equity.

Senior staff engineer (L17): £263K ($225K / €306K) target (£126K base / £137K equity)

While these numbers can still be considered top-of-the-market and comfortably within Tier 3, the difference is that in 2020-2022 they were around 30% higher. With Pinterest reducing compensation targets and Shopify increasing them, I’d expect Shopify’s numbers to be much closer to Pinterest’s than previously.

Total compensation at Tier 3 publicly traded companies fell due to downward stock price movement. A characteristic of Tier 3 companies in the US is that at the staff engineer-and-above levels, it’s common for equity to account for the majority of total compensation. This means when the stock price falls, so does people’s total pay.

3. Nosedive and recovery for new grads’ salaries in the US?

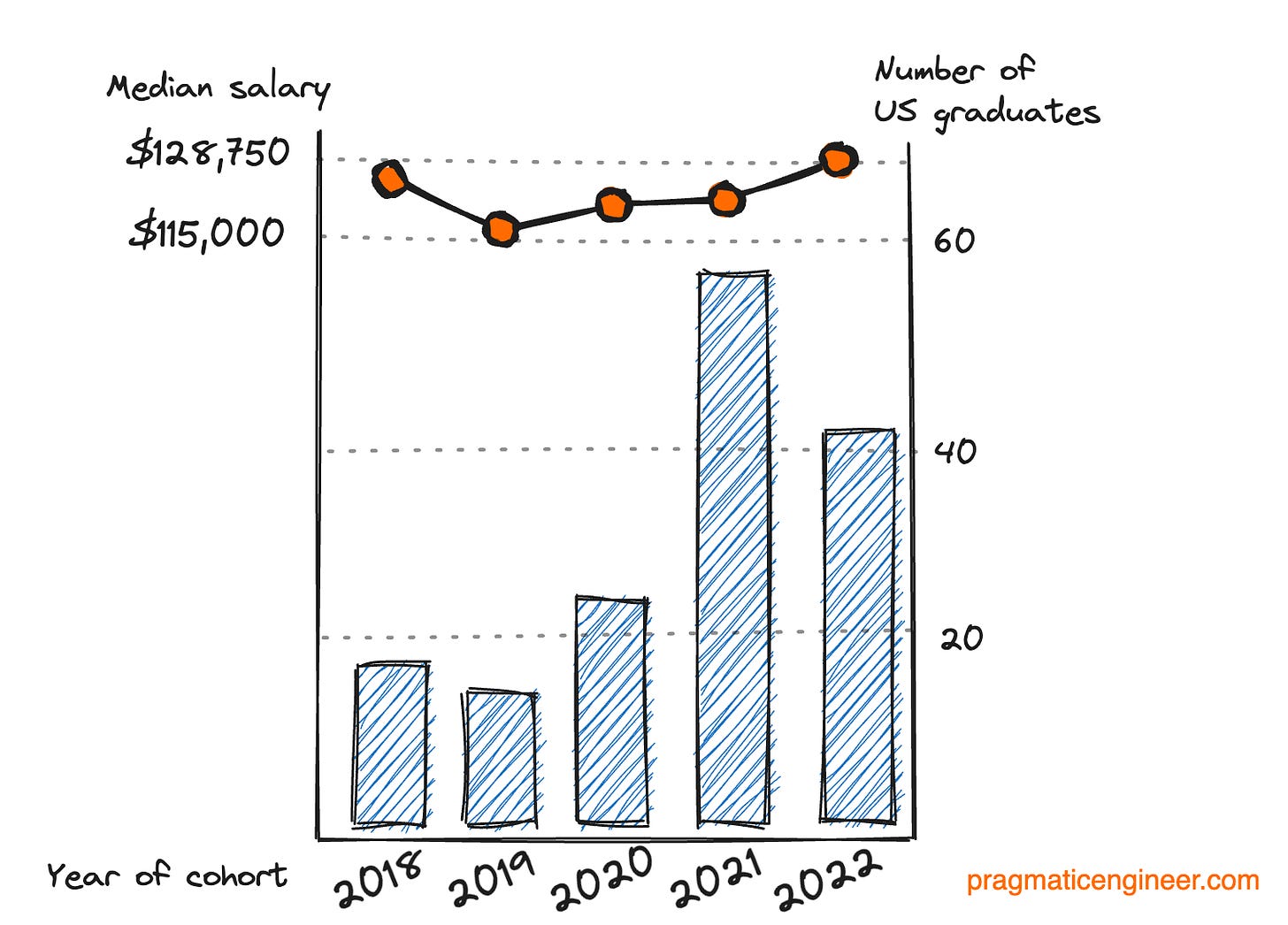

Launch School is a coding academy which markets itself as the “slow path for studious learners to a career in software development.” I started paying attention to it after noticing its very good graduation numbers around the time of the start of the pandemic, when most bootcamp placement rates plummeted.

The school publishes average starting salaries for US graduates. Founder Chris Lee shared that while most students are hired into new grad roles, some are accepted to Software Engineer 2 roles, as well. Graduates are hired at the likes of Amazon, Google, Microsoft Splunk, PayPal and other higher-profile companies.

Here is how median salaries have changed from 2018-2022:

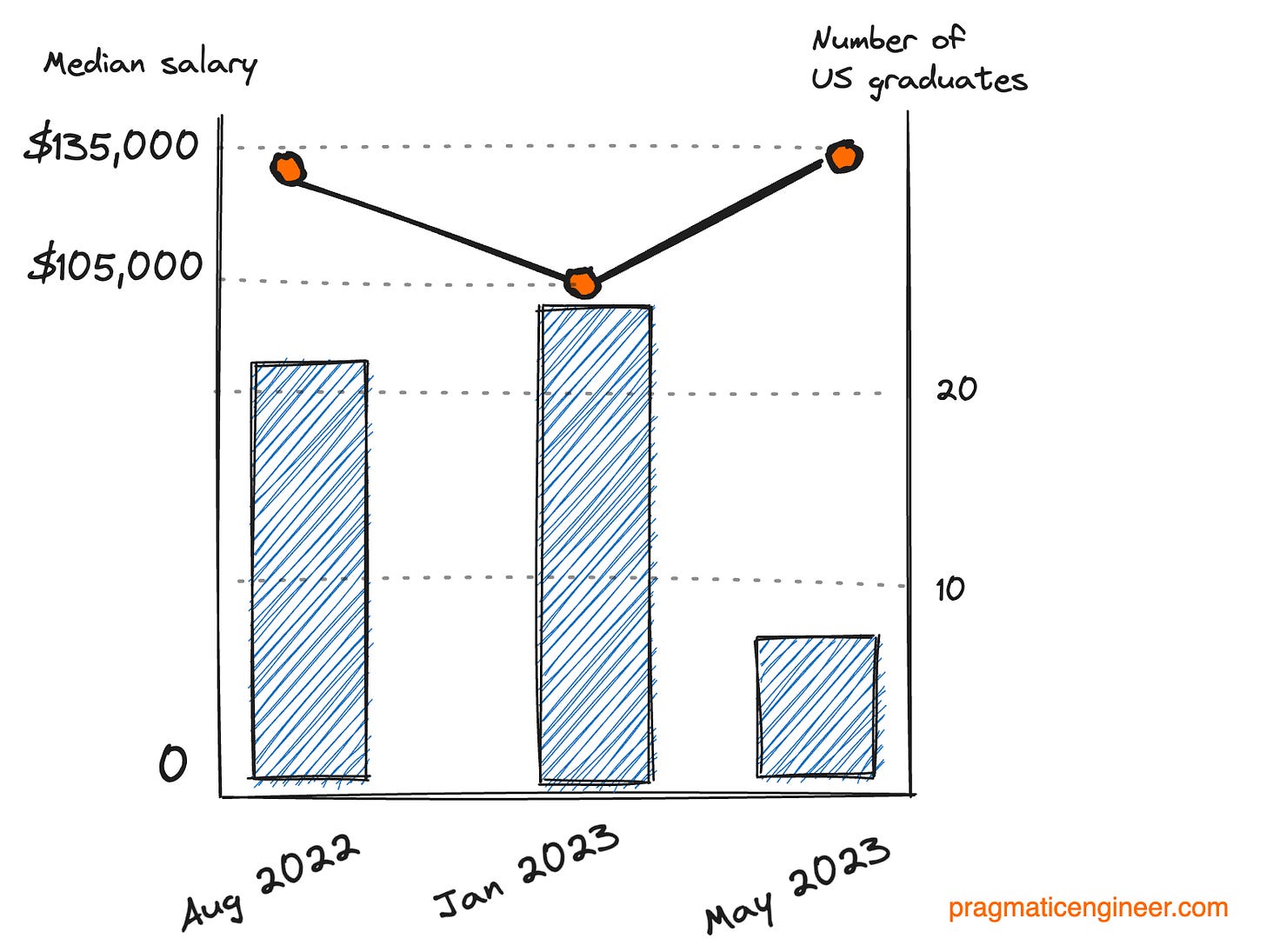

Until 2022, all looked good, with starting base salaries slowly increasing. But then something happened in January 2023: starting salaries dropped to an all-time low of $105,000:

I asked Chris about what students experienced in January 2023. He said:

“The fall 2022 cohort started their job search in January 2023, arguably the worst tech market in 20 years. We knew we had to reset expectations, but we didn't know what to reset it to. As expected, salaries came down and duration went up, but I was pleasantly surprised by the robust results in a terrible job market.

The average salary for this cohort was $103,559 (US only), which was down ~20% from the previous cohort in August 2022. The duration to an accepted offer went up by 18% to 10.5 weeks from the last cohort. We still have pending job hunt folks in this cohort, so the duration number will change once they finish.”

Okay, but then what happened to the following cohort this May, where job offers were higher than before? Chris says:

“Here's where things get interesting. The latest cohort started their job hunt just last month (May 2023) has had amazing results in under two months of job hunting.

Out of 23 enrollees, seven folks have accepted offers with an average of $131,857 [and a $135,000 median]. It's still early so I want to temper expectations, but that's higher than cohort 2205's pre-downturn average. The cohort starting job searches in Jan 2023 only had one accepted offer over $130k and yet the average for the latest cohort is already higher! The sample sizes here are small, but it's still an interesting trend.”

It’s important to note that the sample size for the latest May 2023 cohort is small. And 70% of this cohort is still job hunting. Still, this early sign of the market bouncing back is, indeed, good news, and it suggests new grad compensation might be less impacted by recent events than predicted.

💥 For those who are not paid, this is where the article ends. For some people, half of my articles is enough, and that's fine!

If you'd like to get the rest of the article, you have two choices.

You can subscribe to my newsletter, and get this and all future articles.

Alternatively, you can subscribe to The Pragmatic Engineer, and get his future articles!

I'd love for you to subscribe to one or both publications. Supporting independent writing and education in our industry is a great use of your money (in my opinion). And in the tech industry in particular, reading a few newsletters could create a massive ROI if you are learning along the way.