My Path to Writing a Newsletter, Finances, and Motivation - a Personal Story

A personal reflection on money, drive, commitments, investing, and more.

When I was in school, I disliked writing. The topics of school papers were boring. Fiction writing felt forced. I was motivated to get it done as quickly as possible. Thankfully, I've always typed quickly, which was a huge advantage in getting papers done on schedule. However, once I graduated, things changed.

Writing with personal motivation felt different. I enjoyed writing papers at Amazon. I enjoyed writing long rambling emails to my family about hikes I went on. It turns out that your personal excitement about topics can be hidden by a public education. Ouch.

While working at Amazon, I ended up writing some popular articles. I found I really loved the process of writing for the public. I decided that when I did end up taking a break from a corporate job, I should consider doing a newsletter. When I decided to leave Bezos Academy, I thought that was a good time to take that step.

When I started this newsletter, I spent some time researching how often people write, and how their paid and free memberships work. For better or worse, I dislike pondering decisions for a long time. I always have. This usually worked well at work, since making decisions quickly at Amazon is preferred ("Bias for action"). Occasionally, I'd be seen as rash, but that's a fine tradeoff on average.

Rather than delay my newsletter start, I decided I would write two articles a week. Monday and Thursday. Writing two articles a week was a reasonable amount of work for me, and was a good volume to read. I offered a paid membership, with no benefits at first, simply an offer that people could support me. That worked fine, and I'm thankful to the great people who paid for memberships without receiving any benefits.

After I had enough paid memberships, I felt like I should do something different, so I changed my Thursday newsletters to be paid. Now I had one free, and one paid article a week. This was a pretty simple solution. I like simple solutions. It also gave a benefit to those paid members who were complimenting me with their subscriptions.

Education vs. openness

Here's what I'm going to try. Normally, my articles are aimed at being educational. I write on topics I'm confident about. I communicate what I know, and my goal is that they are usually actionable for readers. I'm confident in my method of running one-on-one meetings, and I can communicate that with authority.

My intention for some articles going forward is to be open with my thoughts. I want these articles to not be authoritative, but instead I will be more open regarding what I'm thinking about, and how I arrived where I arrived. It may be less authoritative, but hopefully, you'll know me a bit better.

It's going to be a challenge because sharing a thought process feels to me like being vulnerable. It's easier to share from a position of strength and factual information. It's more stressful to share my opinions and thought process. It also tends to lend itself to more rambling articles rather than an organized "how to" article. Regardless, I'm going to try it out.

I'll ask you to please let me know what you think, as it's important to get feedback when you're trying something new.

My daughter complained yesterday that I was going to be unavailable today for a few hours while I was doing my writing. I explained that most adults have to be gone all day long. This surprised her. I asked if she could remember when I used to be gone all day. She only vaguely remembered. She's seven, and 2020 was a long year in a child's lifespan. So for this article, I was thinking about my position of being able to write newsletters rather than going to work. How I got to that position, and what it means to me.

Lifestyle creep

I remember being within hearing distance of a group of employees who worked for me at Amazon. They were discussing where they might buy vacation homes. This is the type of conversation which happens when you recently graduated from college, and now you have more money than you know what to do with.

One guy lamented that he had had a condo in Hawaii already, so it was hard to justify owning another place. He said he didn't know what he should spend his money on next, but he was thinking of getting into drones.

High incomes often lead to high expenses. While there are plenty of exceptions to that rule, lifestyle creep is a common thing. If you're in college, and you happened to have a beater car, you were probably happy. Others didn't have a car, and having a car was a privilege. You graduate and get hired by Facebook. You notice many Teslas in the parking lot, so you go and buy a new Tesla Model 3. It's the reasonable model for the new grad. Except that you soon notice that your co-workers all drive better models. You've become less happy with your car because it doesn't feel as fancy as it used to.

After a couple of years of stock vests, and perhaps a promotion, that Tesla Model 3 is feeling old. You decide to upgrade to a better Model because you can afford it, and you can finally have what your co-workers have.

Going back to those employees of mine at work. They were starting their careers, and had some fantastic compensation coming to them. They were also aggressively inflating their lifestyles because they didn't know or didn't care about the alternatives.

I remember distinctly, years ago, going to an executive's house for a holiday party. A few of the execs were chatting near the door, pointing at their cars and talking about the various models they'd purchased. Then someone noticed our family car. "Haha! Who has the Corolla?!" If you looked outside that house, I suppose our used cheap car did stand out a bit. Choices are a funny thing.

Discussions at work

It's interesting how personal finance discussions are biased at work. Everyone happily and openly talk about their expenses. You can hear about the cost of someone's vacation, their new car, or how they bought a boat. I understand that it feels safe and impersonal to talk about buying the latest Sony DSLR. It's oddly more personal and awkward to say that we bought a $9k used car. It's not the normal choice for Directors at a Tech company, and people don't know how to react.

It's wildly more personal and awkward to talk about saving, investing, and thinking about the future. Outside of HR educational discussions, I seldom hear about people maxing out their 401k. Yet, I think maxing out someone's 401k is much more important to your long-term success than buying a better speaker system.

It's an individual choice to decide to spend your salary, but I wonder how many people recognize it as a choice. I talked briefly to those new graduates who worked for me. I said with that excessive money they started receiving, they should think about investing a portion of it for retirement. They looked at me as if I had three heads. I remember one saying something like, "I can worry about saving in another 20 years, I'm going to have fun for now."

Our path

I have no idea how I started researching personal finance many years ago. I know my way around financial things and investing. My wife hates being wasteful with money, so she prevents my wild ideas (we should buy a castle!) from hitting our pocketbook.

We both worked at Amazon in tech groups for over ten years each. We made good money. I knew what to do with the money. My wife prevented me from spending it all. So now I can write a newsletter and hang with my kids during the day instead of working a full-time job.

As a brief summary for those who are interested, we invest in broad index funds (essentially we have a small amount of money in most companies of the world). If you're interested in learning more, I'd highly recommend "The Simple Path to Wealth" by J. L. Collins (affiliate link because why not). Fantastic book. Buying and reading that book is potentially the best investment you could ever make if you don't already have a handle on your financial future.

Expenses vs. happiness

We had many co-workers who made just as much as my wife and me if not more. I'm sure some of them have saved quite a bit. I'm also certain that many of them have inflated their lifestyle every time their compensation grew.

One of the things I've internalized is that there's a limit to how much additional expenses will make us happy in the long run. Plenty of studies have shown that once you pass a bar of "enough" income, future increases in income don't lead to more happiness.

What studies have also shown is that people's happiness with their income is highly tied to what their co-workers make. Make $75k when everyone else makes $70k, and you're thrilled. Make $75k when everyone else makes $80k, and you're upset.

I suspect that this is part of the reason lifestyle inflation happens. You're thrilled with your vacation in your cheap hotel in Utah, until you hear your co-worker bragging about the resort they visited in Hawaii. Humans hate to feel like they have less than other humans.

However, if you can ignore the comparisons with others, you can be happy with less. Or more accurately, be happy with what you already have.

I'm convinced that most expenses beyond the minimum don't make you more happy in the long run. My wife and I are still perfectly happy driving around our used, cheap cars. We're not car people, so a nicer car is unlikely to influence us for long. We would get excited if we had a touch screen in our car, but the excitement of new toys doesn't last long.

While I'd love to have a castle, I think my wife is correct that our life wouldn't be any better if we owned one. I don't honestly think it would change our life fulfillment to have a castle, so it won't change our baseline happiness.

We do spend our money on things which line up with our goals and values. We do love traveling, and spend excessive money getting to far away places. We also always have a high-quality camera setup, as taking photos is important to us. Interestingly, we had a conversation recently that we somewhat wished we hadn't bought such a nice camera. We are now stuck buying the best cameras going forward because anything else would be a downgrade.

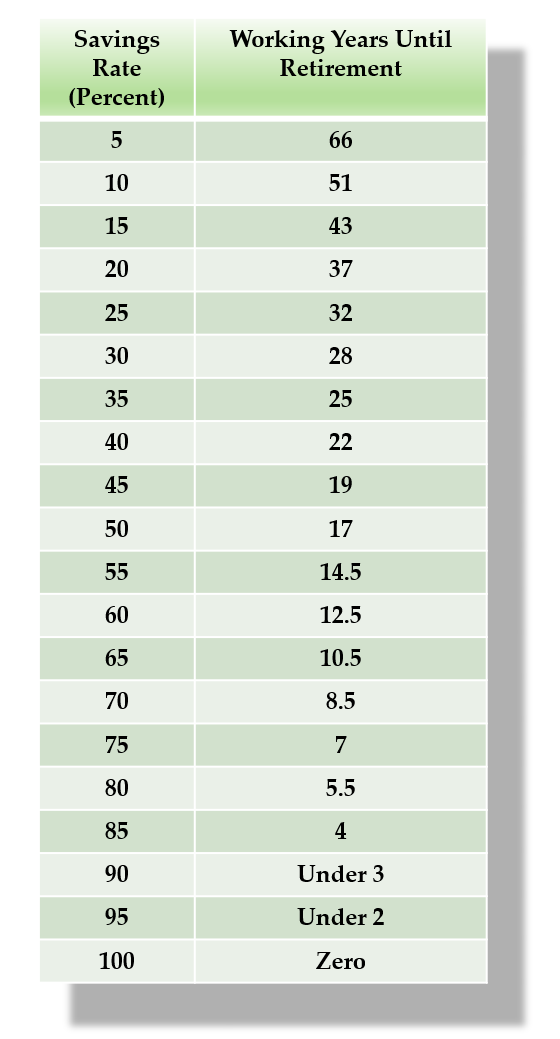

I think if you've made a conscious choice to inflate your lifestyle when you make more money, that's just fine. I'm just against uneducated decisions. One of my favorite charts comes from Mr. Money Mustache's post on The Shockingly Simple Math Behind Early Retirement. You can see the drastic changes in working years you have based not on how much you save, but on your savings rate percentage.

I think many people think about retirement savings in absolute terms ("I probably need a million dollars") rather than a percentage of their income. When you decide to save an extra $1k a year, you've done two awesome things for yourself. You've learned to spend $1k less per year, and you've saved $1k more. This reduces the amount you need to save, and accelerates your savings.

Making more money doesn't necessarily translate therefore into retiring earlier. If you make a Million dollars a year and only save $100k a year, you will still take 50+ years to save for retirement. Your choice, but make sure you're doing it on purpose. On the other hand, if you made $50k a year, and managed to save $25k a year, you're on a path to retire in 17 years. Not shabby.

Time is money. Every day you spend at work is to gain some money to buy things. Everything you buy is then a tiny bit of your remaining lifetime. It wouldn't be unreasonable to compare buying something expensive with throwing away weeks or more of your lifespan in the garbage. Feels a bit creepy when you think about it.

If you think carefully about every purchase, and say to yourself, "Do I honestly believe this will make us happier in the long run or would I rather work less?" it tends to change how you spend your money. It's also more boring sometimes because we don't get castles.

Being driven vs. driving yourself—Motivation

I arrived at the place where I can write a newsletter during the week. Like most people, I spent my entire life until this point being driven by external forces. I went to school every day because I had to. Following school, I immediately got a job, where I had commitments and expectations. I've never had to be self-driven in the majority of my day-to-day life.

Regardless of how high I moved in management, I always had external expectations. I had projects to deliver, and emails to write. I had executives looking for that next project to be successful. I needed the money. I was motivated to keep my job, and do well at it.

Like many people, I also found a version of fulfillment and happiness from being successful at my job. Every good rating I received was personal validation. My regular paycheck was a reminder that I was capable and competent at my job. Each promotion was a set of important people putting their trust in me, and the work I had to put into getting a promotion made it rewarding in the end. Many of us get some of our self-image from doing our work well.

It is shocking to land in a place where you don't need to do things, and you don't necessarily get recognition for the things you do. Part of the reason I started writing my newsletter was that I was worried that without something external driving me, I might not accomplish anything. One of my biggest fears was (and still is) that I might suddenly realize that I had been out of a job for five years, and I didn't manage to accomplish my dreams.

When you have big dreams, it's easy to blame your lack of accomplishing them on your full-time job. "I'd love to build that bookshelf on my own, except I'm so busy with this job." Or in my case, "I would totally write a book if I had more leisure time." Some people are self-driven enough that they start popping with creativity once they have spare time. In my experience, it's not that simple. If you've been externally driven your whole life, it feels different when that drive disappears.

Continuing into the future

I decided to commit to writing weekly because I could give myself an external commitment, and that has enabled me to be consistent in my writing. It's a fantastic motivator.

I haven't figured out how to write my book with external motivation. I tried giving myself the excuse that my newsletter eats up my writing time, but that's lame. I have plenty of time. Procrastination doesn't disappear, but you can trick it. I just need to figure out the trick to continue to be productive on other aspects of my life. Life is a journey, not a destination—as the wise Ralph Waldo Emerson once said. So, I'll keep trying.

Usually, I try to wrap up an article when I've covered a subject sufficiently, but this isn't a subject. This is a summary of some thoughts I've had, and I wanted to try to be open and share those thoughts. I'm about done, and I'll wrap things up for now.

The end & staying connected

If you read this far, that's pretty fun. This turned out much longer than I'd expected. I hope that's ok for everyone. My bad. I'll shorten them going forward.

If you're a paid member, email me. I'd love any feedback you have on this article.

Anyway, I hope you all have a great day!

Thanks for reading! This article was sent to my paid members. However, if you read a paid article which strikes you as particularly useful or interesting, please feel free to forward it to your friends / family / co-workers. I'll count it as free publicity.

If you do get this forwarded to you, please consider subscribing!

Cannot believe it's 2.5 years since the first time I read this article. I was new to personal finance and just started budgeting, new to America, and was naive enough to have just bought a house at the time of reading this article (because why not, everyone said I can afford it?). Fast forward, I decided to leave corporate job after 9 years in Amazon (moved across continents), and head to my World traveling dream. Thanks for the introduction book - simple path to the wealth, it led me to many other books and bloggers, you money and your life, MMM, and many more... At the time, I am packing up pretty much everything into one backpack, I thought to come back and read this article again. Thank you and thank you!